Chapter 17 - The Future

Television, Video, and the Valley

We will wrap this tome up with a look into the future. As the book illustrated, the name of the biggest technological firm to come out of the area will no longer have a physical presence in the area. On the surface you might think that would be analogous to Philly, without cheese-steaks or cream cheese, or Denver without omelets, or Chicago without stuffed pizza.

The sad fact is that in the Grass Valley/Nevada City area today many have never heard of the Grass Valley Company. Fewer and fewer know what the "Group" refers to. The author had a doctor who had an office in Grass Valley and never new about a video industry in the area. Even fewer in the two towns know that the original Atari game console was engineered in the area. Nor the mine owner that set in motion the events the led to the area for a while claiming the moniker of "Video Valley." If it was not for that mine owner, as we saw in chapter two, there very much might have been a company originally headed by Dr. Donald Hare, but it might have evolved as the Fresno Group!

Television is sometimes referred to as the Fifth Estate. This nomenclature originated in 1380, by the theologian John Wyclif who declared that there were three estates 'ordained by God.' The first was the Clergy, followed by the Barons and Knights and lastly the Commons. Today those would equate to government, the church, and the people. In the 18th century we got the notion of the fourth estate, because of the earlier invention of the printing press. Today this is generally regarded as being the press. In 1932, The London Times reported that "radio has been called the fifth estate." That was soon extended to television. Today many argue that social networking and the Internet are now the Fifth Estate.

It is interesting that what was widely considered the Fifth Estate, broadcasting until recently, is now being supplanted by the world wide web. Not too surprising in reality, considering what we saw in the last chapter. Television, or video and audio has continually evolved. The more rapid evolution was in the technology deployed. It generally made the viewing experience better by improving the picture and sound quality and allowing the creators of programming to bring much more creativity and features to the content.

Historically though broadcasters were always slow to embrace changes that did not improve the bottom line. Many broadcasters fought furiously when they were forced to move away from analog to digital transmission. In the late 90s the author once sat in a meeting where the general manager of a station told his chief engineer that he would fire him if he caught him spending money on the process of "going digital," even though it was being mandated by the FCC.

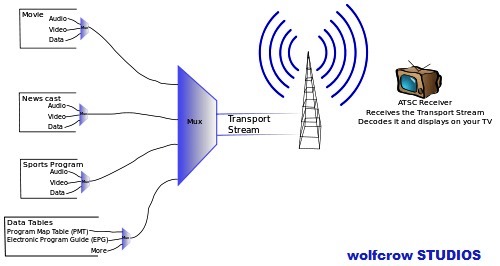

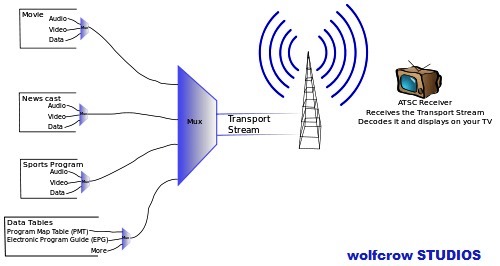

Digital transmission meant that broadcasters could offer HD. Most early on were not interested. When they found that the new technology would allow them to transmit more than one program at once, they originally opted for "more," instead of "better quality" HD. It was ESPN in 2002 that mandated that any production company providing programming to the cable network, mainly sporting events, had to do it in HD.

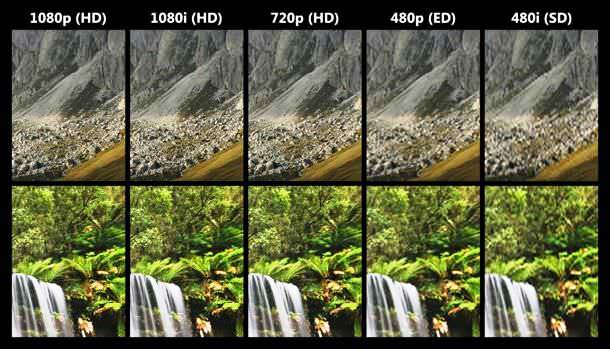

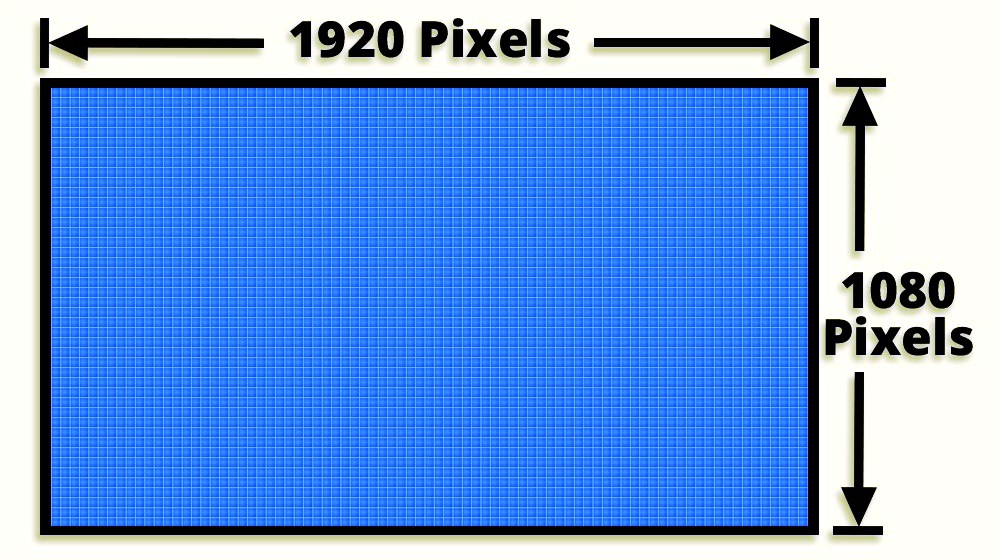

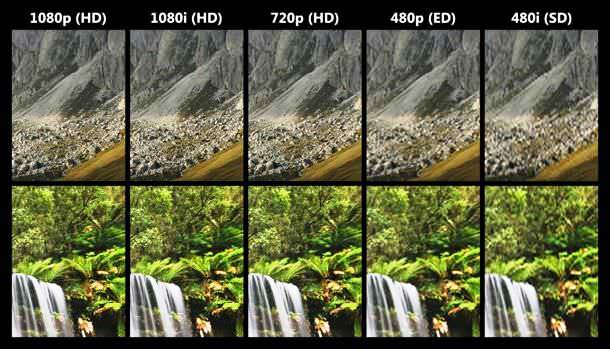

Up until then the main problem facing the industry in regard to HD, was that as we have seen, there were two standards. Colloquially known as 720p and 1080i, half the networks and stations used one, and the other half the other. CBS, NBC, and PBS were the alphabet networks that use 1080i, ABC (including ESPN), and Fox where in the 720p camp. While 1080i offered more spatial resolution, 720p offers more pictures per second. ESPN and Fox, big on sports, decided more pictures were better. Much earlier we talked about interlaced video, sending half the lines of a picture at a time. With sports and all the replays this leads to slightly degraded quality, on top of the fact that there are fewer pictures per second. The P stands for Progressive. Simply means that all the lines in the picture are sent each scan.

The log jam was that since these networks contracted out all their sports production, at least equipment wise, none of those companies wanted to have to invest in two sets of equipment. Up until then cameras and other equipment, could be produced that would work in either standard, the problem was that the camera would slightly compromise the quality of the standard it was not native to. A 1080i camera would make slightly degraded pictures in 720p, and visa-versa. The industry claimed, deceptively in many cases as many did not want to invest in HD, that they would not accept video that was not generated in its native format.

Philips, before its camera division became part of the Grass Valley Company, came to the rescue. It offered a camera that they claimed was native to both. Actually this was half true. With a clever piece of engineering they made it true vertically. Horizontally, the format change was done through interpolation. This was enough for ESPN to force HD upon their vendors. HD took off.

With no motion in the picture 1080i & 1080p will look exactly the same. Same with 480i (what was the Standard Definition format) & 480p. 480p was a standard that Fox pushed for awhile.

Technology is now solving the two format issue, as a standard is now available that combines the higher spatial resolution of 1080i with the higher picture count of 720p, naturally called 1080p.

Going back to digital transmission, more programs verses HD issue. Technology eventually solved that problem also as compression technology improved to a point where both could be done at once.

These technological leaps are one of the reasons our band of video companies in the area are in such a tough business. New formats, as we just mentioned, seldom bring more revenue into the broadcaster. They are usually mandated by government or to stay even with the competition.

As Chuck Meyer, CTO - Production, Grass Valley Company put it: "New formats never increase revenue for broadcasters. They are compulsory requirements, or table stakes. Broadcasters must re-tool their entire facility for a new format, as each facility is developed around that format. This takes years of planning. In the meantime, a small investment is made in a trial system for the new format. For broadcast equipment manufacturers, the result is a bump in sales for these trials, followed by a lag, and then the greater market curve."

As we saw in chapter 14, a very big reason why Belden recently sold the Grass Valley Company was that it is a "lumpy" business revenue wise. There is no reliable way to meet steady earnings quarter after quarter to keep Wall Street happy.

In many ways the clientele of our band of companies is shifting. Birney Dayton, founder, and President of NVISION, which was spun off from the "group" and eventually became another company that was folded back into the Grass Valley Company, said "If you look into the broadband industry there is not much need for the broadcast industry anymore. TV delivery systems are totally unrelated to the TV industry. The satellite companies inserting the local stations, via very convoluted methods, into their channel lineup (local into local) is an artificial construct and has no fundamental need to exist. The counter argument is that you need to preserve local content, but then stations are now central casting. How is that any different than running many things out of El Segundo (DirecTV's central satellite uplink center)?"

Central casting is where a number of stations spread out geographically in various cities are run from a central location. If you walked into master control in one of these station, it is a lights out operation. In many cases there is not even a master control anymore in those stations. Consolidation through central casting is another drain on equipment sales.

Meyer says that the industry is in a format stall, and that the worldwide penetration of HD is nearing 100% of the available market. Those counting on 4K will find it will not pan out in the home as most do not have enough viewing space available to appreciate its enhanced resolution. It will mainly be used in theaters, and signage applications. The next quality improvement in receivers will most likely not be increased resolution, but what is being called Ultra HD (UHD). This will increase the accuracy of the colors displayed and increase the dynamic range between light and dark areas of the screen, but not increase the pixel count.

As we saw in the last chapter, software is replacing hardware in many cases, and that software is changing the fundamental workflows of the industry. Dan Castles, President, and a founder of Telestream says video and audio quality is not the absolute imperative it once was. Now many content producers will trade some quality for shorter time to air. Telestream creates products that allows creators/distributors to manage the trade off between time and quality.

Broadcasters have lost most of their control on program delivery and how it is viewed. Plus the barrier to entry for competition is rapidly evaporating as you do not need to make a large investment in production equipment and delivery. Today it is simply conceiving a good idea for compelling content.

Content delivery is rapidly being taken over by 5G as the "over-the-air" solution, and by GigE networking via cable connected receivers.

Even the local news and emergency alert arguments that are made to keep local over the air broadcasters transmitting now have plenty of alternative distribution paths. So the traditional broadcasting environment, actually all program content and delivery, is evolving a new set of players.

Anna Greco, Senior Vice President of Telestream Client Services says that the majority of Telestream's customers are not traditional broadcasters like they were when the company started. Traditional TV facilities are now less than 50% of their customer base.

One thing at this point that is probably keeping the old broadcasting model together is Sports. Many wonder if politics now in sports will kill it. The majority of the viewers are middle and working class and tend to run more conservative and patriotic. The most profitable of all sports leagues is the NFL. In 2020 the networks paid a combined $6.25 billion a year to air games. Ad revenues which came in at about $5 billion. While historically the NFL has been a loss leader for the networks, with ratings down nearly 20% over the last few years many advertisers are starting to ask for rebates.

TV news, which use to be a large cash cow is also losing steam. The network morning shows, namely Today and Good Morning America (GMA), produce the majority of the revenues to fund the rest of the network's news organization. In 2019 Today brought in over $400 million, and GMA $375 million. Compare that to NBC's Nightly News which brought in $146 million, and Meet the Press, $26 million. A generation and half ago evening network news shows were appointment TV. That habit by most of the public slowly evaporated. Now the same thing is starting to happen with the flagship morning shows.

A final straw that might bring the traditional television broadcasting house of cards down is "Must Carry." That is a rule enacted by the FCC, which originally said that locally licensed television stations must be carried on a cable provider's system. That has evolved into a game of poker between the broadcasters and the cable and satellite providers. Cable systems pay most cable networks some money per subscriber. Today the highest priced cable network by far is ESPN, which commands over $7 per subscriber. That is over three times higher than the second highest network, TNT, which is over $2/sub. Most networks receive less than a dollar per month.

It is interesting that just over 20% of cable subscribers watch ESPN regularly. That means that the actual cost per viewer is well over $30/month.

Broadcasters and cable/satellite providers in dispute

Eventually the local stations, backed up by their networks, if they were affiliate with one, turned the table on the cable and satellite distributors and started negotiating carriage fees for themselves. Since the local affiliates were the gatekeepers for ABC, CBS, Fox, NBC, and a few other smaller over the air networks they had leverage. Most local stations manage to get between $1 and $1.50. All this adds up and explains why many cable and satellite subscribers pay over $100 a month for service. Partially because of the high and still rising cost, many are "cord cutting," getting rid of their cable service. 6.2 million subscribers canceled their service over the 2019-2020 year. If the networks ever decide that local affiliate stations, cable, and satellite service is not worthwhile, and decide to go the Netflix distribution route, that will leave no rational for most broadcasters to continue.

"Cord cutting" usually means not the total elimination of cable service, just the cable companies legacy television distribution service. Many cord cutters keep the Internet part of the service. This is leading to what is called Over The Top (OTT) subscription service. Netflix Internet service is OTT. Some of the network late night shows are starting to format segments of the shows for YouTube or subscription viewing. Other shows are following suit. The networks, both on air and cable only, until recently did not want to allow subscription viewing of their programs, as they wanted to protect the revenue they got from the cable and satellite providers and not make it easy to cord cut. Now with cable subscriptions dropping anyway, many are rethinking the subscription models.

Broadcasters are actually now starting to rethink their "over-the-air" business model. In 2012 the FCC set up a convoluted auction system where stations could offer to turn in their current channel and move to a new one. The goal by the FCC was to carve out increased spectrum for wireless services. Broadcasters had a similar thing happen in 2009 when Sprint paid to give broadcasters new gear for their 2GHz microwave equipment to free up 5 MHz of bandwidth for their cell service. The pressure to get broadcasters to give up their channels will continue to grow as wireless and cell service continue to explode.

It should be noted that the losers when the traditional "over-the-air" transmission of television finally ceases will be those in the lower social-economic rungs of the ladder. "Old fashion" TVs connected to antennas is still the cheapest way to receive television programming for many in that situation.

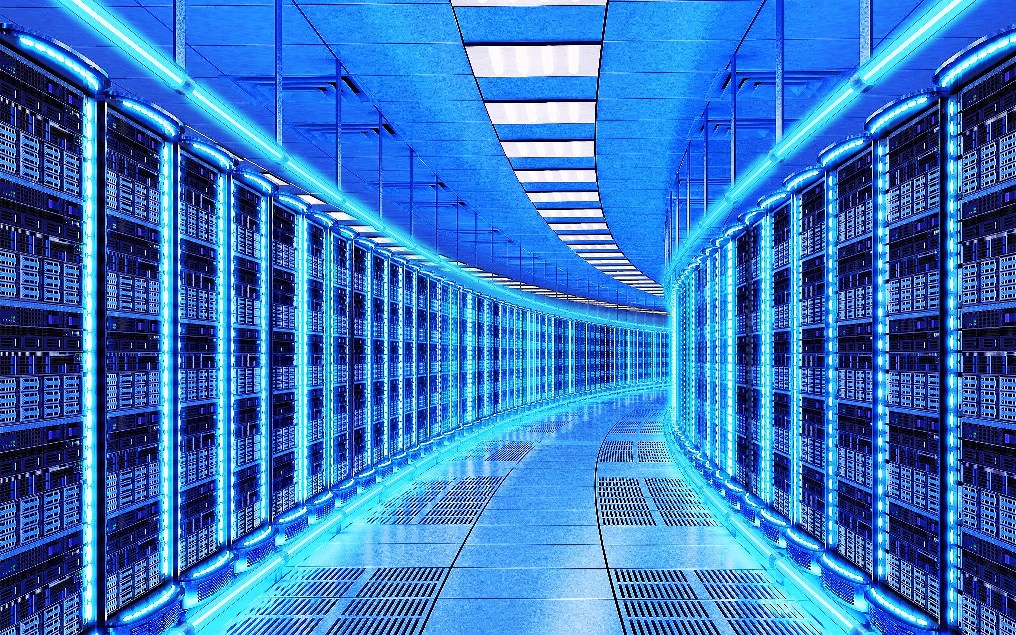

Another loser will be the environment. No, not in a dramatic observable way, but power consumption overall will rise. Data centers consume vast amounts of power. IP routers takes eight times the power of a TV router. Big IP routers are not cheap to buy or run. Also with the increased speeds available through todays networks the data rates will keep increasing. Faster clock speeds mean increased power consumption as we mentioned in chapter 8. Not only in the generation and distribution of programming content, but also the power consumption at the viewing device, be it a regular receiver, or a phone.

As mentioned the clientele that the video band of companies in the area serve is radically changing. A big new customer base is the Cinematography industry. It is a different business that is now using the same technology as the television folks. The broadcast industry uses cinematography as it always has, for programming. Primetime feature shows are often a cinema product using traditional TV for distribution. This implies that in the future if networks wanted to, they could enter and compete with cinema. This also means that the cinema business could bypass the networks through their use of Content Delivery Networks (CDN). This is actually already being done by Netflix and others by their production of their own content.

Absolutely no film required!

The whole video industry has become so divergent and convoluted that the NAB has not been about traditional TV in about 25 years. The industry has changed so much that today it is alien to many old timers in the industry.

While Grass Valley/Nevada City is no longer a television Mecca, it will continue on as a high tech center. Grass Valley is still considered one of five premiere video centers in the world.

What are the other 4? The video industry employed around 2000 here at its height, making it per-capita, the highest area in the world with people working in the industry. The Grass Valley Company employed over 900 people in the area alone. Today the number working in high tech is around 500.

In an effort to turn the areas fortunes around

The Green Screen Institute was formed. It enlisted an advisory board that includes executives from companies like Samsung, EA, Fandango, and active virtual reality investors. Their mission is to fund entrepreneurs who will create software or content that will form the basis of successful virtual reality businesses.

Technically can the area stay relevant?

While a fairly robust technology colony still exists in the towns, it faces a number of existential threats, both internal and external to the area. From glacial forces in technology and business, to state and community issues, and even threats to the area from mother nature, and the 800 pound gorilla in this arena is not earthquakes, it's fire! We will see this shortly.

But technical relevance still looms large. Del Parks, President of Technology for the Sinclair Broadcast Group and others have said that TV needs better pixels and not more, as we have already mentioned. What that means is 2K resolution for the home is good enough. What is needed is more dynamic range and color space. HDR (High Dynamic Range). Plus new wider color space (Wide Color Gamut or WCG) which gives more shades and tints of colors like green. Humans evolved being very sensitive to shades of green, especially at night. It helped us gleam what was dangerous in the brush.

Only nations like the U.S. would have enough living space to sit far enough away to benefit from 4K pixels instead of 2K. Now many are arguing that 1080P HDR is what will become the new standard.

(Where is this additional color/gamma space put? Is the bitrate upped some?) A good thing with stopping the pixel count at 1080p is that it will lessen the bandwidth demand on the Internet, which allows for more users, which equates to broadcasters and content providers making more money.

And a company like NetFlix, can now produce its own content, and send it Over The Top (OTT) to the home. As recently mentioned, OTT is the use of Internet service only to view media, and not using any traditional "channelized" service like cable or satellite. There is no need to wait for a broadcaster to deploy UHD/HDR/WCG to provide this picture upgrade. The sets are for sale now and very affordable. A 65" LG OLED providing 4k, HDR and WCG can be purchased today for more than 50% less than its HD, 2k predecessor when HD first rolled out in 1998.

There is no format stall in the traditional sense. There is no barrier to entry based on format and protected regulatory status. There are screens, cameras, recorders, and cloud storage, all deployed today. All are ready to support 4K, HDR, and WCG. In contrast to the roll out of HD, where the broadcaster was essentially first, screens were expensive, and content was scarce. This time screens are cheap, content is widely available, and the broadcaster is essentially last.

The stall is with the broadcasters, because they need to determine their new world business model as their power to control advertisement value has been severely diminished. In 2014, Linear, or appointment, that is traditional TV viewing, was eclipsed by some combination of time-shifting, near Video On Demand (VOD), VOD and streaming, most of which is OTT today. In 2016, Advertising spent on digital media eclipsed that of linear, or traditional, TV.

To quote Chuck Meyer, "What is disrupting Broadcast? It is not IP. It is what IP technology enables."

This is a total refactoring of their business model. It is disruptive to nearly every aspect of their business. Companies like Grass Valley, whose primary customer needs to redefine how they do business so as to recover and make a profit on the content they create. They must also be able to monetize, in as many new ways as possible to cover the cost of live sports, today the priciest of all programming.

How to move to this new brave world? The business could take the inexpensive, it's good enough route. Such as using inexpensive Adobe software which can do everything a switcher can do. Just not in real time and with as many channels.

Or broadcasters can buy into the GV universe by investing in AMPP (Agile Media Processing Platform), what the company calls a scalable SaaS platform. This platform, or ones like it, would have everyone writing their applications to it. Much like Xerox did when they started in the late 50s, you did not buy copiers, you bought copies, and rented the machine. Grass Valley is thinking that their platforms would be rented by the hour.

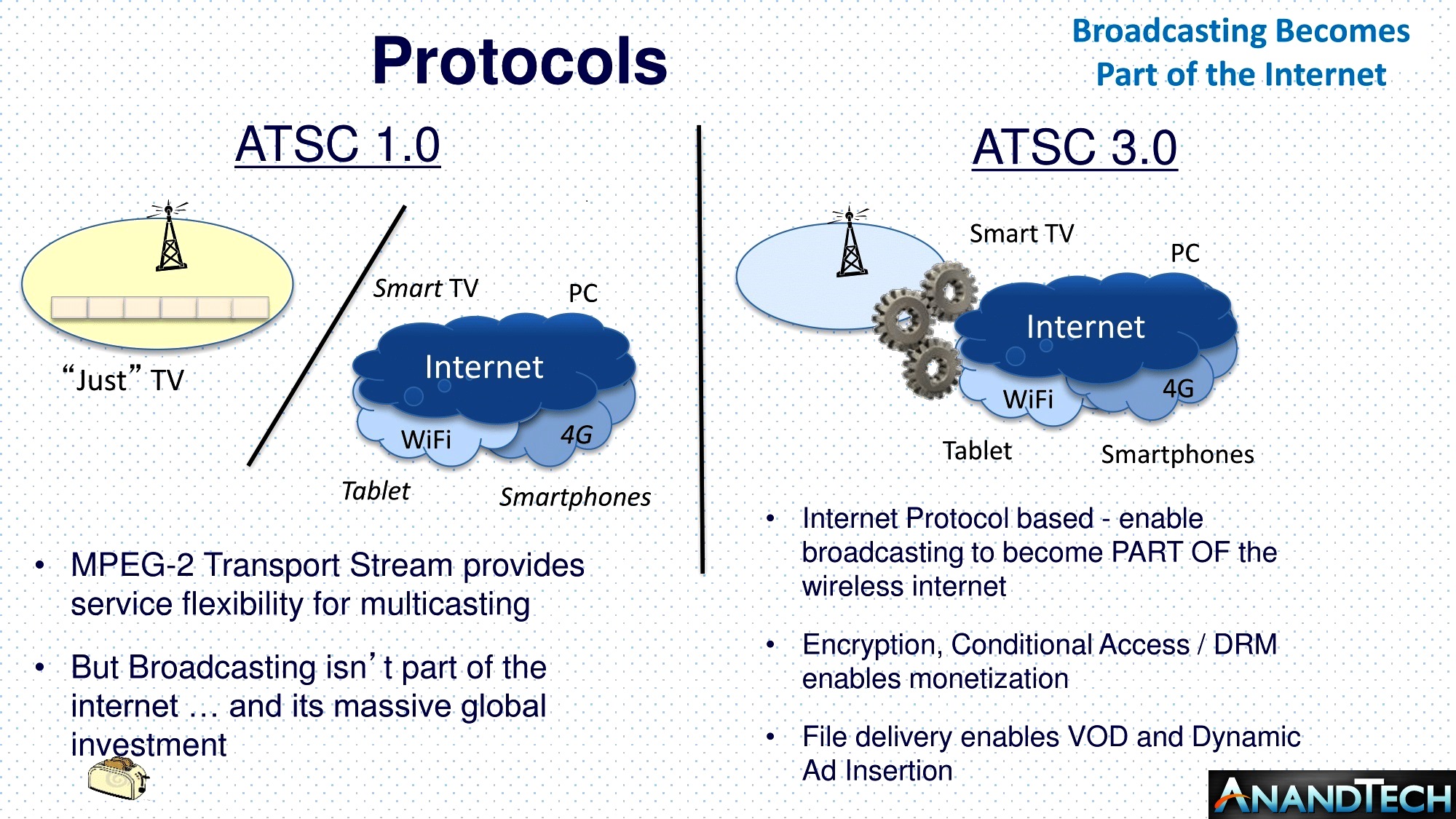

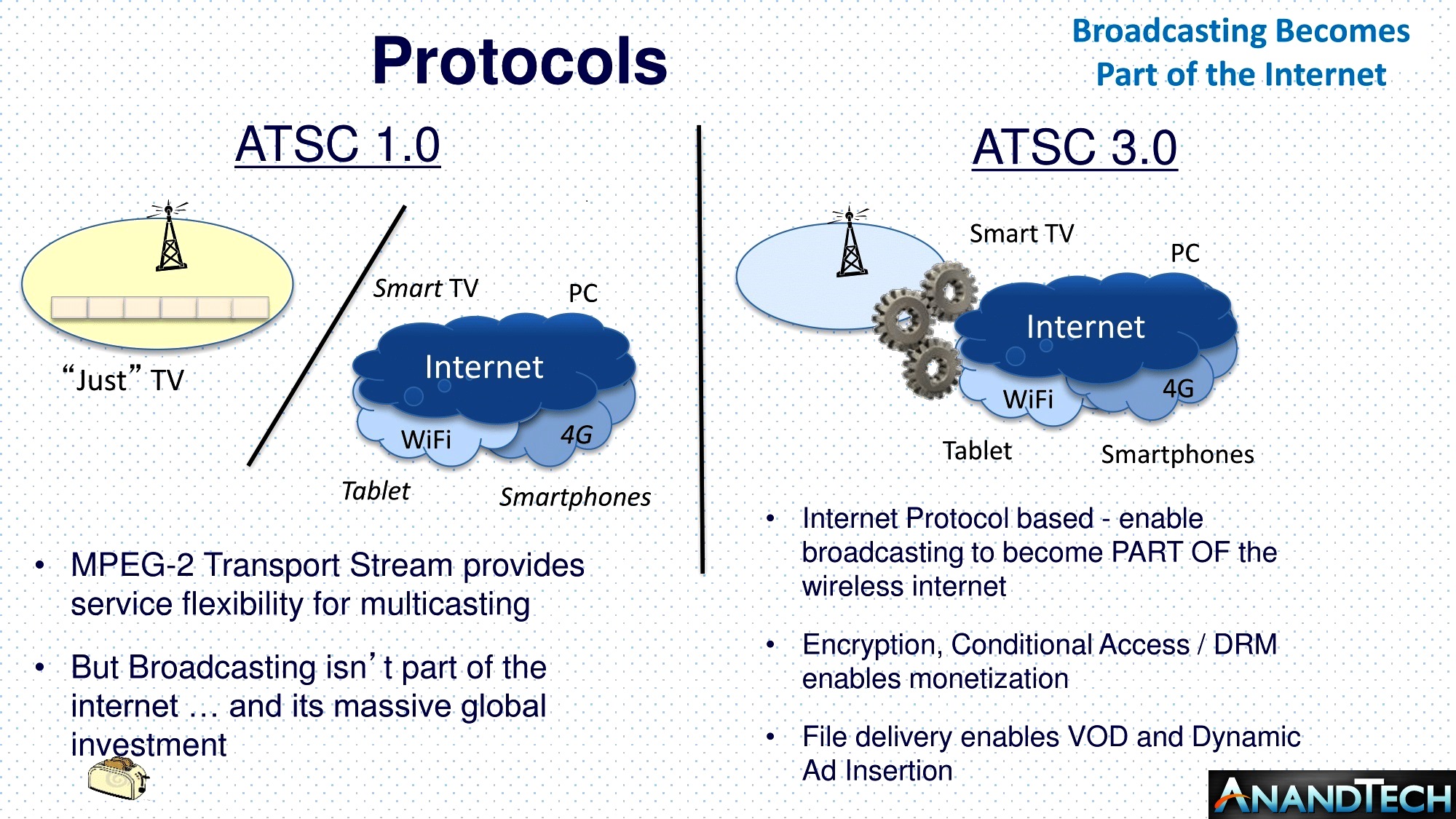

The advent of ATSC 3.0 is likely to be too late to be much of a factor in the broadcaster's new business model. Competing data services such as 5G and LEOS (Low Earth Orbit Satellite) GigE, will provide ubiquitous, high bandwidth to the home. Why buy something that only provides TV? Why buy limited data services from a smaller pool of providers? The consumption of video is no longer on a particular device, or a device in a particular mode. It is simply another form of data.

Even providing Emergency Public Service announcements and information is not a monopoly of traditional radio and TV anymore. 5G and LEOS can provide much more resilient transmission to PDA/Cellular devices. The verdict is out on what happens to broadcasters' tall towers and high powered transmitters. Will they find a way to be relevant and not just become scrap metal?

What happens to the traditional Content Delivery Networks (CDN) like cable and satellite. Do you even need scheduled delivery of content anymore? Are the Amazon Prime and Netflix delivery on demand to become the new model. Outside of sports and breaking news there are few "discussions around the water cooler" must see events anymore.

Companies like the ones in this book will increasingly peddle data driven automation capability, which will use local data to optimize the workflow of the various content providers. That optimization of workflow will have to be done through machine learning, by analyzing data, and optimizing a given process or an hierarchy of processes. The new "big four" prime time broadcasters will need networks of systems to deliver content, millions of streams of programming that can adapt on the fly, without the necessity of a traditional traffic and master control operations.

That is at one end of the spectrum, the other is a single person who becomes a media caster overnight. While this is not new, attesting to all the YouTube and tick-toc channels, the new technology will allow those type folks to greatly ratchet up their game, or even more easily collaborate between groups of them.

This means the vast majority of future products from the likes of Grass Valley will be software, running on generic, but very powerful hardware platforms. Outside of that there will be generic user panels, joysticks, etc. Years ago Grass Valley had a product that would allow one model switcher's control panel to control other model of switcher. Non-off-the-shelf hardware will only be found in the most demanding applications, where power is precious, rack space is a premium, and latency considerations for human interaction determine the workflow.

Back to the common platform problem, is that with SAAS is that you have to go through a revenue trough and get to the other side. As we already mentioned a few times, but worth repeating, customers will not generally pay what software is worth. They will pay for things they can touch, things that have mass. The software to control that hardware, was often just thrown in. Now almost, or all of the physical surfaces that a production person touches might all be someone else's keyboard or joystick

This means there will be a new Microsoft, Google, Apple, or Facebook, in television production. Maybe one of them! Who will it be? The one(s) who are early to market and can either saturate or control a significant percentage of the market, then commoditized it, making it hard for others to enter in a big way, and finally one, or possibly a few will monopolize the market. Jobs was the first with the iPhone. Apple still has the largest "app' store.

The China Problem

Let us start with an overseas gorilla that has taken over a large part of the electronics industry and has very different agendas than what the area grew up dealing with. Asia has been a challenge to the U.S. electronics industry for a long time. An interesting stumble from grace includes Dell, whose original business model was to sell directly to end users through the Internet. But as the market moved more towards tablets, Dell's efforts fell short in that area, and all the PCs coming out of Asia, especially China, put Dell in a race to the bottom profit wise. A race to the bottom with China was a losing proposition. As others have done to find a survival strategy, it could have offered something China did not, provide end to end service that many larger customers now want, but Dell decided not to. As we will see shortly, a small company just down the road from Grass Valley found a way to take the manufacturing behemoth on.

Most hardware-only products face the risk of them being commoditized. A prime reason for this is the development of cheap shipping. This changed how the development of products are done, and how companies are organized. In the early 80s China took prime advantage of that. China opened four areas for foreign investment with less than normal government oversight.

The one that exploded to the top is the city of Shenzhen. In 1980 it was a town of 30,000. Today it has 18 million inhabitants. It might be the fastest growing city in human history. It lies just north of Hong Kong. Now Shenzhen is the electronics manufacturing capital of the world. It is known as the "Silicon Valley for Hardware." It is also called the "hardware capital of the world." Sony, Samsung, Apple, Microsoft, Canon all manufacture in the city. It is claimed that 90% of the world's electronics are made, in part, in this city.

Shenzhen

Shenzhen is now part of the world's largest megalopolis, which covers a significant part of China's manufacturing heartland and includes the cities of Shenzhen, Guangzhou, Foshan and Dongguan. This area has a greater population than Argentina, Australia, or Canada.

What made this city ground zero? In the beginning it was simple economics that drove this. Where a U.S. plant would pay $15/hr in labor, Chinese plants would pay $3/hr. But everything was cheaper. In Shenzhen, a full meal is still $3. China holds down the exchange rate. This means western economies can buy more. China does not tax exports and the US does not generally tax imports. The US does not charge custom fees on some imports, although now they are taxing some ICs & semiconductors.

China made it easy to invest there. Many venture-capital firms targeted the area. At least one has targeted hardware startups and has setup a hardware accelerator and incubator facility. Shenzhen got here from its manufacturing roots, which created a technologically adept labor pool, and because of this critical mass a very close supply network. Since Shenzhen is in the center of suppliers the supply chain is shorter. Also, all the intelligence that leaks out of all the companies here allows companies to respond quickly to new trends. The city leads China in patent applications. Of all the world this is where the hardware ecosystem has jelled the most. Designers, manufacturers, wholesalers, and shippers have formed a complete ecosystem.

Whereas prototyping elsewhere often takes 4-5 weeks, in Shenzhen it takes only a few days and often at a quarter of the cost as elsewhere. Years ago, National Semiconductor spent two years to develop a new chip, a company overseas took only six months to reverse engineer it.

Because cash has long been a favorite burglary target, and people are less and less likely to have lots of it in the house, electronic devices used to be at the top of a thief's list. But a recent property-loss statistic from the Federal Bureau of Investigation claims that today's electronics devices make for less attractive burglary targets than those of past decades because they quickly become out-of-date.

Many foreigners come from around the world to spend time in Shenzhen to develop their products, helped by the support structure that has been assembled here.

Shenzhen now has one of the largest container ports in the world, and UPS has their Asian shipping hub at the Shenzhen airport. In addition, two cargo airlines, along with two Chinese passenger airlines are based at the airport.

But it is not only electronics, companies like Alibaba have large sheet metal fabrication operations here. Makerfabs, a large printed circuit board (PCB) manufacturer, has operations there also. The area can build complete products in a very short time.

But prosperity in Shenzhen is pushing prices up there and as manufacturing is becoming more automated, some of that automated manufacturing will move back home. But that does not spell doom for the area as the electronics industry there is moving up the food chain and are increasing innovation and branding of their own. We have seen these centers move before. So, no matter where you are, you better figure out what your value added is.

Until recently much of what came out of China was called Shanzhai products. There are two explanations of the term. One came from Cantonese slang, Shanzhai factory, that meant products from an ill-equipped, low-end family based outfit. The second might be based on Shenzhen. Shenzhen started its electronics legacy by building imitation or knock-off products designed by others. Again, it is suggested that people who speak mandarin Chinese with a Cantonese accent sounded like they were saying Shanzhai product instead of Shenzhen product.

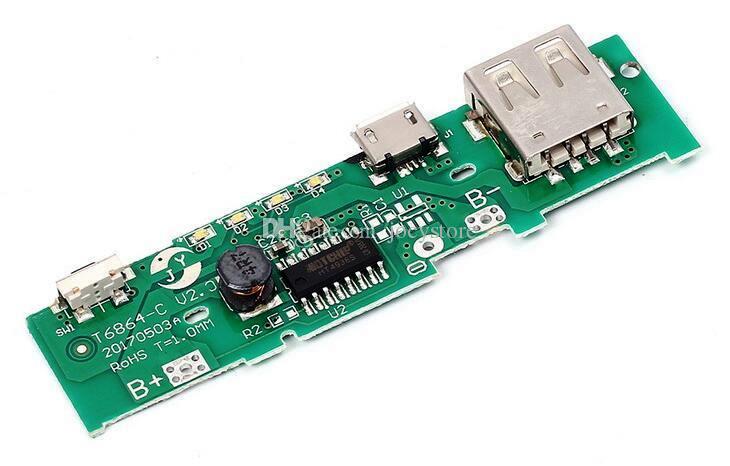

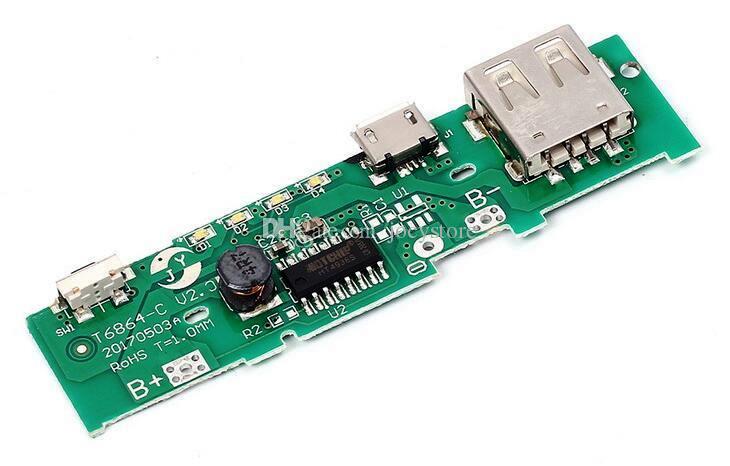

So, as we have mentioned already, places like Shenzhen rode the first wave of electronic innovation, the commoditization of parts. The second wave is the creation of whole platforms, that is complete development boards, what the Chinese call gong ban, or public board. These can be incorporated into another's products directly or the user can build atop it via modifications. Many boards are developed that cater to smartphones, tablets, smart watches, smart homes, or industrial controls, to name a few.

Today these boards are often referred to as Shanzhai also. These boards are often created by parts manufacturers to ease the introduction of their products into the marketplace, or even by parts distributors to increase their sale of the parts they handle. This new use of Shanzhai allow features that mainstream civilization might dismiss. Such as multiple SIM cards in phones for frequent travelers, or phones with multiple speakers and mics so more than one can talk over a single connection or slimmed down features for those who cannot literally afford all the bells and whistles. These platforms or public boards allow for products that have limited distribution as you do not have the cost of designing from scratch and can more readily be customized.

So, what does Shenzhen have to do with the Grass Valley area, besides the fact that there is a good chance parts in locally produced products came through there? Engineers and designers in the area must keep in mind that their value-added proposition is the intellectual property that can be integrated into the product. Unless it is a very large organization, that can do its own fabrication, it most likely is not going to be the hardware that makes a widget compelling, it is how it does what it does that counts. The Grass Valley area cannot offer many "me too" products that might have wider appeal, because if they do not have a way to make it cheaper in six months, the commodity providers will swamp their efforts in research, and manufacturing prowess in short order. Large companies like Xiaomi, and Huawei have most everything in-house and can quickly integrate many features that were in separate products and suddenly your neat stand-alone box is part of someone's smart phone or other platform.

The Chinese iterate many times until they get a manufacturing sample and then copy it a million times. Hard design is a small part of that process. You cannot afford this in low volume/high mix manufacturing that companies in the Grass Valley area engage in.

Local companies have used Asia for manufacturing. Thomson, which owned the Grass Valley Company for a number of years, had everything made in Vietnam. The problem is that this is only economical if you make many, not a few, which companies in the Grass Valley area do not do. If you are building offshore a few ECOs (Engineering Change Orders - namely to fix mistakes) that crop up can throw any savings right out the window.

Since companies in the area have a low volume/high mix group of products, they need to achieve economic manufacturing with a quantity as low as one. They need to make one of something and also make money at the same time.

If a local company ever did develop a trans-formative product that was in demand by millions, and it could be easily duplicated by others, it would have no choice but to manufacture it somewhere else. David Paul Gregg invented the CD, which was amazing and changed history. But you have probably never heard of him because CDs are not difficult to make, and lost relevance over time. Most things work this way. As soon as a smart product or business idea becomes popular, the urge to copy it, and commoditize it, is the strongest force economics can unleash. Jeff Bezos summed this up when he said, "Your margin is my opportunity."

It is no accident that much of Apple's manufacturing happens in and around Shenzhen. First, the city is strategically placed, serving as the gateway between mainland China and Hong Kong. It is one of the largest shipping centers in the world, with a massive container port.

Second, the Chinese government established Shenzhen as the first Special Economic Zone (SEZ) in the country. SEZs are designed to encourage enterprise through relaxed planning regulations and generous tax incentives and, crucially, to facilitate foreign investment in local companies. It is this, as much as its geographical advantages, which has enabled it to grow at such a pace.

Third, that SEZ was established way back in 1980, meaning that the city has had over 40 years to grow into the manufacturing center of the tech world. Apple relies on a huge network of suppliers and sub-contractors, some of which may make just a single tiny component. The majority of them are based in Shenzhen and its immediate surroundings, so the logistics of bringing everything together in one place for assembly are straightforward.

But we will close with Apple in a potential bind in China. A couple financial constraints including that almost

2⁄

3rds of their revenue and profits come from the iPhone. Again almost

2⁄

3rds of their revenue comes from two countries, 43% from the U.S., and 20% from China. But the high markup that Apple has placed on their iPhones is pricing out many loyal customers in China. With premiums so high it is allowing local competitors to charge their own comfortable premium, at a price still less than Apple.

In recent years with new, much more strict Chinese leadership, Apple's situation in the country has gotten much more complicated. Apple, more than any other company, has been vulnerable to the government's harder line. In 2001, right after China was admitted to the World Trade Organization Apple began manufacturing there. Over the years Apple executives have had to compromise their stated principles, and to placate the local authorities and has aided the Chinese government's vast censorship operation of its citizens.

Over the years the Chinese government spent billions of dollars paving roads, recruiting workers, and building factories, power plants and employee housing to help create Apple's supply chain.

But now it is under pressure to do more to conform to the Communist Party's wishes. Partially, this was done by the government imposing laws that the company could not practically obey. In response to this Doug Guthrie, once one of America's leading China supporters, said in a New York Times article, "This is the point. You are supposed to be out of compliance. Not so they can shut you down, but so you'll figure out what they want you to do and figure out how to do it."

But there are more systemic issues in dealing with China. During the pandemic it quickly became apparent that China had cornered the PPE market. At times U.S. companies like 3M and Perkin Elmer, with manufacturing plants in China, were not allowed to export products back to the U.S.. Companies that were trying to manufacture PPE in the U.S. had to face predatory pricing from China. The ubiquitous cotton mask, which cost about seven cents to make, were being dumped in the U.S. for about a penny each. But as the pandemic wore on, it was not always low prices, at one point price gouging was engaged in. The state of California found itself paying $3 for N95 surgical masks, which cost about 75 cents to make, because of a China instituted shortage.

Ceronix

About 20 miles south of Grass Valley, also on highway 49, is the town of Auburn. Near the city's airport is an impeccably landscaped property behind a black rod iron fence, with a large pond. A sign on the front fence says welcome to Auburn, A bird sanctuary. There are 312 birds on about five acres of property. In the pond are 3000 Koi. There are many social events held on the property.

The property sits in a 253 acre industrial park, whose largest tenant is now PG&E, the local power provider. The largest employer in the park was at one time laser manufacturer Coherent Inc. It once employed 800 employees at a four-building campus. By 2009 those buildings were empty and are now gone as PG&E tore them down.

That building with all the birds and fish is eco-friendly also. The owner has made a big investment in clean energy, with a roof-mounted system of solar power panels, covering the acre-and-a-half-size roof of its building. The panels paid for themselves within four years of installation and now returns excess power to the grid.

The company's dedication to clean air and clean energy also includes:

• Setting aside four acres of land to be free from development, then creating a pond that supports area wildlife.

• Designing an environment with as much natural lighting as possible, which has the added benefit of giving employees views of the pond and wildlife while working.

Besides doubling as a wildlife haven, the property is home to Ceronix. It is a company that competes directly with the Asian, including China's, gaming industry. It has thrived for many years, as the owner of the company, Don Whitaker, found ways to compete. He does it not by manufacturing overseas. While at one time it was a totally vertically integrated company, today they manufacture just about everything but printed circuit boards, in that lone building.

Don worked at the University of California, Berkeley for 10 years as a machinist and tool die maker. He started a company on the side called Kevex (1000 Electronic Volt Ex-Ray). He was working in the group at the university that invented a detector that through Xray and fluorescence, detected the elements in the periodic table. That expensive machine only output was into an oscilloscope. Don and another researcher modified a Sony receiver to display that output in color, and with four others formed a company.

The company grew to 300 employees. It branched out into other products. At one point they developed their own Xray tube, a division which Don ran in Scott's Valley, near Santa Cruz. Besides Scott's Valley the company also had facilities in Foster City, Burlingame, and San Carlos, all cities along the west shore of the San Francisco Bay.

The company went public, and the stock went up 20:1. Perkins Elmer came in and wanted to buy, but Don did not want to sell it, but his four other partners did. Don was 37 at the time. So he sold his house in a couple days for more than it was worth on top of a hill in San Mateo. Went in to quit and got talked into staying for two years during the transition, and he also got a bonus to buy another house, which he did in Foster City. Perkins Elmer moved the company to Texas in 79, due to the cost of doing business in California, even way back then.

Don moved up to the Sierra foothills between Auburn and Grass Valley and retired. On a trip to Las Vegas he saw an early video poker machine. It used a modified Sony receiver, something he knew about. The problem that the company offering the gaming console had was that Sony would change the design every few months. Don had been looking into building a component video monitor while at Kevex but when they were bought out the new company said no one would be interested in his monitor.

He approached the consoles manufacturer, Fortune Coin and said he was close to having a monitor ready. Asked how long before Fortune could have them Don said 4 months. He got an order for 1000. Don called up the designer he had worked with, who also happened to be living in Auburn. They finished the design in Don's garage and kitchen table. then moved into a 3000 square foot metal building near his present building and started manufacturing.

He started the company with $577K. To finance that he cashed out his 401K, mortgaged his paid off house, and maxed out 19 credit cards to bootstrap the company. He soon had many other clients, and his company partnered with another company to develop capacitive sense touch panels, which was a large improvement over available resistive panels at the time. These ended up in thousands of gaming machines.

As mentioned at one time Ceronix was a fully vertically integrated manufacturer, which included stuffing their own boards, with auto insertion (threw hole - before surface mount) equipment. When heavy microprocessor use came about, which by then were all surface mount, he found he needed to invest in all new equipment. He decided to opt out of PCB assembly in 2005 and sold the equipment he had to the Chinese.

In the early 2000's everyone in the display business were reducing prices to compete with the Asians, especially the Chinese, as they were determined to take over that business. The Feds brought some relief in 2007 by bringing a lawsuit against the Asian companies for collusion and seven top executives of Asian companies went to prison in Lompoc California. This episode only cost the Asian companies $38 million in fines. In effect they lost the battle but eventually ended up winning the war. Today there are not any monitor manufacturers except Ceronix still in the US.

By the mid-90s the Chinese, and other Asian companies had come to dominate the CRT market. In response the U.S. Government put a 15% duty on CRTs, and also wiring harnesses. Ceronix was getting its CRTs from China, as U.S. sources had dried up. But while CRTs had tariffs, incredibly to this day there is no duty on a completely assembled video monitor with a CRT or other display installed. So Ceronix went through the efforts to get the Port of Sacramento (Auburn is 25 miles northeast of Sacramento; and yes Sacramento is a sea-going port 79 nautical miles northeast of San Francisco) to apply for and receive authorization to make the 21 acres around Ceronix a Free Trade Zone (FTZ).

This allowed Ceronix to bring CRTs, and later LCDs and LED displays, in duty free and convert the commodity status of a display into a video monitor, so now it is in a different harmonized tariff schedule. So Ceronix is under an inverse tariff where individual parts cannot be brought in and sold without a tariff but completely assembled video monitors can (inverse duty). This was a savings for Ceronix at one time of over $1 million/yr.

Companies like Walmart often have warehouses in FTZs so that they do not pay duty when it comes in from overseas but is deferred until they ship it out. It is a cash flow issue. They do not pay duty until the retail, not the wholesale level requests it. There are 186 active FTZs in the United States. More than 2,900 companies currently utilize the program. FTZs provide significant advantages for U.S. based firms. Duty Deferral: Customs Duties are paid only if and when goods are transferred out of the Zone and into U.S. Customs territory. Foreign Trade Zones allow companies to bring items onto US soil without paying the duty tax, allowing them to store these goods free of tariff charges, or use parts to manufacture a finished product that can then be exported without the US import/export surcharges.

This led to Ceronix's unique business plan. Today their main business is providing replacement gaming machines to casinos; and they do that on 24 hours' notice. Ceronix specializes in short lead time replacement of gaming machines because the revenue lost by the casino is greater than the premium paid to get a replacement, and to do that Ceronix needs to maintain a high inventory, which many large companies would consider a bad investment. Today the company is a $10 million/yr company with $8 million in inventory at any given time.

Ceronix's largest customer now is a kiosks company (Coin Cloud). They do all the ones for Bitcoin. While they cannot be competitive with the Chinese in the kiosk market, they compete in higher quality and short lead times and small batch orders. The Chinese normally require hundreds, even thousands of orders before they will build.

At its height, the company got up to 105 employees. And was producing 150K CRT systems a year. Now putting out 25-30K flat display panel systems per year with 22 employees. The company is as profitable as they were when they were doing the 150k.

Ceronix can't compete with the Chinese business model – high volume, low cost, OK quality, 1 and 2 year warranties, long lead times (6-8 weeks), with his business model of low volume, no backlog, generally shipping that day any orders before 10am. The company has no order backlog. The only orders beyond the next day are ones for large orders such as an order for 100 kiosks. When that happens Ceronix will build 50 the first week and 50 for the following week. Although often they would just build them all that week. From the time they start kitting an order to the time it is ready to ship is 2 hours. They average building about 100 units a day, sometimes 150. Each of their 520 products have different kitting situations. Ceronix is a very small and niche version of the Amazon model. Almost all of their products are under $1K, with the average around $550. Why does this work? The average gaming machine makes $450/day. It is often easier just to replace it then repair it.

Don admits that it is a crazy business model. He says no one wants to develop a similar business model because of the upfront inventory cost. The cost of developing the 520 products they offer is steep. But now with the company in a sustaining phase the company does continually receive offers to sell. So it seems that while most would not want to have to build up the company over the years with the long term investment in engineering and inventory, now that it is done, ongoing returns has invited the interest of others.

From an accounts receivable standpoint many of the company's customers are casinos. If a casino is slow to pay, they can be reported to the gaming commission who can suspend their license to operate if they are determined to be in financial distress. Kiosks are a different story. They take longer to pay. But the bottom line is that the company only has a few thousand dollars in bad debt per year.

We have alluded to the difficulties in dealing with Nevada County earlier and will touch on that a little more in this final chapter. But let us add a little antidotal evidence here. Auburn is in a different county than Grass Valley/Nevada City, it is in Placer County. While Ceronix's first building was in Auburn, Placer County, Don lived in Nevada County, about 8 miles north of Auburn. When it came time to expand he looked at moving the operation to Nevada County. He looked at a number of sites in Nevada County, even part of the Bitney Springs site at one point. He also looked at three other places in the county. He even put $20K down on one location but could not get the county to sign off on the necessary permits. So he ended up staying in Placer County in the Auburn area.

Attracting Talent to the Area

Sierra College Grass Valley Campus

To stay a viable high tech area you must attract, or grow tech talent, and then keep them. A problem the area has right off the bat is that there is no four year college, let alone an engineering school in the immediate area. It is increasingly hard to attract talent to the area.

In the early 80s the Grass Valley Company started a liaison program with the local two year college, Sierra College, to turn out electronic technicians. Back then there were about two technicians for each engineer employed. The techs built prototypes and debugged them. They built and maintained the engineering labs. At the end of the assembly line where product would undergo final testing, that was done generally by techs. Same with field service support.

Over the years the design and prototyping process became much more automated. Designs could now be much more reliably virtually simulated. A lot of the debugging process was done in the design software. The need to use specialized test equipment, which the techs were trained to use, diminished. Equipment became more reliable and can now often be diagnosed and fixed remotely, so the field service force dropped. The need for electronic techs dropped to a fraction of what it was. This is true not only with companies here, but universally. Producing technical talent, shifted from two year programs to four year engineering programs. Even hardware engineers are more and more going the way of the tech, as software engineers now far outnumber hardware engineers.

Now many people have the ability to learn to program or code without upper division college classes. They can master the algorithms, or procedures that need to be applied to various types of data. Maybe without the structure that is taught in a four year engineering college. These schools emphasize a systematic, disciplined approach to software development and its evolution. Often this must be applied in the implementation of large software systems.

To do this efficiently the code has to have high dependability. This encompasses safety, security, and reliability of the system. But there must be other development disciplines in place to achieve efficiency, usability, accessibility, and very importantly maintainability.

Much of what is imparted into upper division software engineers is radically different then what hardware engineers face in their curriculum. While hardware engineers deal with a lot of software today for development and testing, they are users and not developers of those tools. Also, another overlooked fact is that just because the word "digital" is thrown about continually, at the very lowest levels of hardware design, especially with ever increasing data speeds, analog is still going strong. The hardware engineer, even when at the highest level is working on a "digital" circuit, analog still rules in many cases.

So it appears on the surface that software engineers might be able to be home grown, as all the analog attributes are an abstraction down in the hardware layer, the biggest impediment is not learning the programming language in use, and the difference between decision and loop structures for that language, the biggest impediment is often the development tools that software engineers use.

The viability of the area's high tech colony might rest on how well and fast the area can mint functioning software technicians and have the actual software engineers oversee the design process. Thus the age of the technician, albeit software ones, might be making a comeback.

The area's Economic Resource Council commissioned a survey of the top 20 things impacting business in the area. Good broadband service was not on the questionnaire. Many wrote on the survey - broadband! Neither the county nor the city officials got it. Broadband was slow to come to the area and it is still spotty. Nevada County eventually coughed up $250,000 to jump start broadband. There are still only two fiber paths into the area. Up highway 49 from the south by AT&T and up highway 20 from the west by Comcast. To this day many locals still fight efforts to expand cell and other wireless services.

Besides broadband the area does not have another thing that millennial's want: affordable housing. There are few rentals in the area, housing prices are high, even by California standards. The area also caters to tourists, so a lot of the available rental property has been turned over to services like Airbnb.

Another issue is that there is a lack of other industries, so often there is not enough diversity for both spouses to work. Many who are recruited are single, and not intent on putting down roots.

Talent that does get lured into the area, generally new graduates, often just stays a few years before they go off to live their life's. Lack of talent means it is hard to scale a business and since it is so expensive to move here, the area recycles a lot of the locals. Many wonder what will happen when the current talent pool retires.

Even when it comes to executive talent the area is a hard sell. When Dan Castles retired the first time from Telestream, the company first tried hiring a CEO who continued to live in the Bay area and would commute the 140 miles to the area during the week. That did not work out for either party. The second try found the company actually re-organizing and purchasing another company in the east to give the next CEO a home base to operate out of, as he was an east coaster that also had no desire to put down roots in Nevada County. Eventually Castles was forced out of retirement to retake the reigns. More than one Telestream board was concerned with the company being headquartered in Nevada County.

Local companies have found it hard to even lure people out of nearby Sacramento. Again local housing in Nevada County, along with the cost of living, is higher in the Sierra foothills. The ones that expressed interest often were not up to the challenge that operating a high tech company in Nevada County presented. As was mentioned in chapter 15, that some companies in the county are what are referred to as "lifestyle" companies. These are run by people who like the area and run a business that plays in the video high tech game. They are able to meet payroll, and keep the lights on, and are content in the niche they created. While there are local communities of engineers, and other talent, the upper management group spread through the area does not have much of a peer group locally.

It is not just technical talent that is hard to recruit. Castles sits on the local hospital's board, where they have a hard time recruiting doctors and other professionals.

Mary Willington who was with a small business agency in Nevada City said this about local students:

A students go to university and never come back

B students go to State and stay in the area where they went to school

C students get jobs in local mom and pop companies

D & F students get jobs in government

The Towns

The two towns of Grass Valley and Nevada City have different personalities even to this day. Grass Valley is more open to business, and they will expand city limits to accommodate business. An example is Crown Point where a number of high tech companies, along with the building that the Grass Valley Company is selling, reside. The Providence mine site that the company had was Nevada City's first expansion of the city limits in about 90 years. Ken Myers, GVG facilities manager at the time sold the idea of annexing the site as the sales tax would accrual to Nevada city. He also arranged to donate about 1/3 of the property to Nevada city for a waste treatment plant.

Nevada City wants to preserve the past, and the city makes it very hard to tamper with any of the storefronts. They want the historical look. It is said that Nevada City folks are more arrogant, but that Nevada City schools are better. Another common perception is that ex-hippies run Nevada city, sometimes the Nevada City Council reinforces that conception.

While Grass Valley has some quirks, it is far more open to change. Nevada City is not business friendly. Car dealers, and other major commercial enterprises are in Grass Valley. Folks either love or hate the area, if you are into the urban, you are not fans of the area. The HR at Grass Valley Group used to call it pine cone country. Some find that quaint, many do not.

Nevada County, as a whole also has an anti-growth bent. Building permits and inspections can be agonizing. County officials are often considered capricious. The author knows one county resident that one day had the county declare that the house he bought was now considered a barn and he would have to move out. One of the reasons the Grass Valley Company moved out of the Bitney Springs site was the increasing encumbrance the county was putting on any construction there. At one point the company wanted to replace a building that burnt down. The county treated it like a brand new build with all the hoops new construction had to go through.

But the bottom line is that high tech industries help the economy of the area, they have well paid employees, and help fund the community through sales taxes. It is surprising how many who live in the area do not realize that there is a high tech enclave within. Many think of the area mainly as tourist towns, and such have more than their share of good restaurants and art. Those attributes are helped greatly by the money high tech dumps into the local economy, surprisingly unbeknownst by many locals.

Infrastructure

Fire

In chapter 7 we looked at how fire affected the Grass Valley Company. A much larger cautionary tale happened recently just 48 air miles to the northwest.

The November 2018 Paradise or Camp Fire (named after Camp Creek Road, where it started), was the deadliest and most destructive wildfire in California's history. Covering 239.6 square miles, killing at least 85 civilians, destroying more than 18,000 structures, it ranks number 13 on the list of the world's deadliest wildfires; it is the sixth-deadliest U.S. wildfire. It was ignited by a faulty electric transmission line about eight miles east of town. The winds blew it westward and it quickly climbed up and then down a couple ridges destroying a couple small towns before it got to Paradise and proceeded to destroy about 95% of the structures. It burned for 17 days and at times was burning through an area the size of a football field every second. It continued burning westward and got to about 6 miles from the city of Chico, which has about 100,000 people. It was 2018's most expensive natural disaster in the world in terms of insured losses.

Known as the "River Fire," it burned to within 1o miles of Grass Valley

One positive thing that came out of this is that PG&E is now planning to bury 10,000 miles of power lines in California. This is about 10% of its distribution and transmission lines. The utility thinks the cost will be between $15 and $30 billion. Another is that there is a concerted effort to clear an invasive species filled with highly flammable oils, scotch broom which has invaded the area.

Closer to Grass Valley and Nevada City, a half a dozen fires have broken out west and north of the towns since 2017. The largest was known as the Willow Fire in September of 2020 and burnt 1311 acres about 15 miles west of Grass Valley. Recent fires also include the August 2020 Jones fire, started by a lightning strike, that burned 705 acres just northwest of Nevada City. While the fire raged about 4,000 were forced to evacuate while another 16,000 residents were advised to be prepared to evacuate. One of the roads closed during the fire was Bitney Springs.

While lightning storms do not happen often in most of California, they tend to happen more frequently in the hot summer months in the Sierras. This is because warm air rises up the western flanks of the mountains, pushed along by the prevailing westerlies off the Pacific, cooling as it gains altitude. Moisture in the air then condenses, creating clouds, rainfall, and occasional lightning strikes.

Between Nevada City to the north and the Nevada County Airport to the south is an area known as Banner Mountain, named after the 3902 foot Banner summit. It saw its first a fire lookout tower in 1911. The current tower is 60 feet tall and is manned by volunteers from June to November. It has 81 steps from the ground to its observing platform. From the tower you can see down into the Sacramento Valley to the west, Auburn to the south, The ridges around Lake Tahoe to the east, and Mt Lassen to the north.

This prime fire spotting location has one other fire connection. Many feel that it could be ground zero for a devastating fire. From just north of the airport and going east up towards Scott Flat reservoir could be the archetypal recipe for a conflagration. Lots of trees, with houses intermixed, and hillsides that are like highways for fires that like to race up a slope.

Cal Fire North Operations Division Chief Jim Mathias has stated that due to droughts, the county has 124 million dead-standing trees throughout the Sierra Nevada Mountain range, primed to burn. A problem that the area faces is that people move into those areas for the seclusion, prizing the trees as a damper between neighbors. If each cleared 100 feet of space around their homes in the Banner Mountain area everyone would see each other and that is not what the crowd wants. They want their own cocooned nesting grounds, cut off from each other. Obviously the denser the tree cover, the more fuel in these neighborhoods.

After the Paradise Fire it has gotten very hard to get insurance in the area. Insurance premiums in some cases have tripled. Many companies are not even writing policies in the area. Even finding a company to issue a policy at the much higher rates, you still generally need 100 foot clearance around a house and 5000 gallons of water on the property for the insurer to declare that it is minimally fireproofed. Counties cannot fix this, as they would face a screaming hall of homeowners. Only insurance companies can fix it by requiring fireproof checklist to obtain insurance. The problem is the state will fight against the insurance companies saying they are being arbitrary. But the bigger problem is the threat to the ongoing vitality of the area if the worst happened, as is a large portion of the money in the area is on Banner Mountain.

It is not only Grass Valley and Nevada City, many worry that mountain towns, especially in California, might become an endangered species.

Underbrush near Tahoe. Taken a few years ago

There has been an ongoing debate over the state's forest management. Many point out that the underbrush has been ignored for so long that it has created perfect tinder to burn the trees.

Some claim the destruction of the lumber industry was a mistake. Many in the environmental movement sought an end to clear-cutting. Many point out that clear-cut areas provide fire breaks.

The thinning of brush out between trees has been blunted. Even the selected harvesting of trees to lower the fuel load is fought. No more cutting and replanting. The goal is a laudable one, saving the natural habitat. That is until it is burned down.

Common sense is often in short supply. Most fire ecologists say that the surest way of preventing massive forest fires is to use prescribed burns. The California Environmental Protection Agency states that "prescribed burning is the intentional use of fire to reduce wildfire hazards, clear downed trees, control plant diseases, improve rangeland and wildlife habitats, and restore natural ecosystems."

The goal of these prescribed burns are to keep the forests healthy by burning up the underbrush that accumulates on the forest floor and by thinning trees. The Forest Service has concentrated on fire suppression, and not prevention.

This problem is not a state problem but mainly a federal one. The federal government owns 45.8 percent of California's land, while 4 percent is owned by the state and 51 percent is privately owned. CAL FIRE manages both state and private land. Part of the reason it is so difficult to manage California' forests is the bureaucratic milieu. The Forest Service manages 193 million acres of land across the country, has 28,000 employees, and has an annual outlay of $7 billion a year, according to a 2017 Analytical Perspective from the budget of the U.S. government.

The Forest Service has performed prescribed burns on an average of just over 1% of the forest they manage per year. The policy of fire suppression has created what insurance companies call "mega catastrophes," a term that describes disasters that result in insured losses of more than $1 billion. Mega catastrophes are becoming the norm in California. In 2017, the Forest Service stated that there were 5,906 fires on California state and private land. In 1993, 1,797,574 acres of wild lands burned, but in 2017 this number had jumped to 10,026,086 acres.

From 1960 to 1990, 10.3 billion board feet of timber were removed from federal forest land each year. From 1991 to 2000 that numbered dropped to 2.1 billion board feet of timber per year. "There's an old adage that excess timber comes out of the forest one way or the other. It's either carried out, or it burns out," California Congressman Tom McClintock said in a speech supporting "The Resilient Federal Forest Act," a bill that stops the practice of taking fire prevention funds to pay for fire suppression. It also was intended to streamline environmental reviews so that forest managers don't have to fill out hundreds of pages of documents just to cut down rotting and diseased trees. While passed, this bill continues to be debated and modified.

One reason more trees are coming under duress is when they are too close together. They fight for resources. Many of the trees are weakened and become more susceptible to disease and insect infestation, making those trees into tinder boxes. A 2017 report from the U.S. Department of Agriculture states that 129 million trees have died in California's forests since 2010.

The goal might turn out to be not how many trees there are, but how many healthy ones.

Power and Other Infrastructure

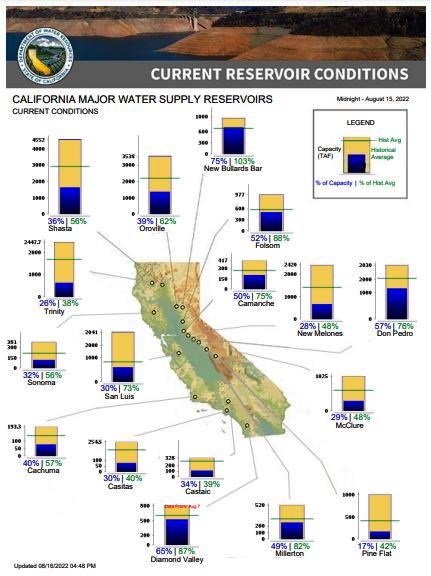

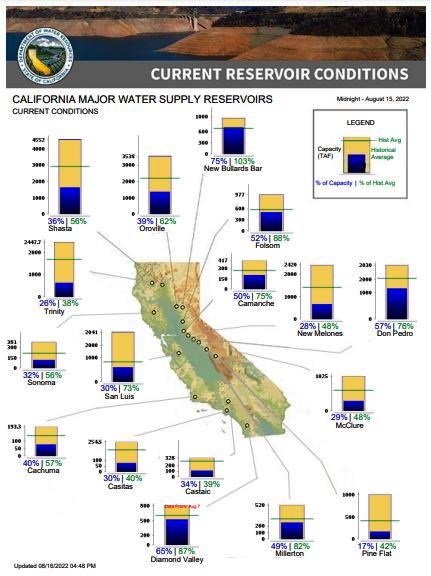

Major California reservoir levels on August 15th, 2022

The state has a trifecta of troubled parts of its infrastructure. Fire being the first, water being the second. Damn the dams! Let the fish have their habitat, keep the water flowing to the sea, empty the reservoirs for the one-inch Delta smelt! While water policy in the state is not as draconian as the previous two sentences would imply, it has been a constant topic of debate as soon as European style agriculture and urban centers cropped up.

Water in California has always been considered a finite resource. Low enough that almost all of it is allocated to various agencies and governmental agencies. Many lament that there has not been much new capability to the state's water infrastructure for a very long time. In fact periodic reduction of water storage is brought up from time to time, by the elimination of some of the state's 1500 dams. Some farmers, in what is billed as the country's breadbasket, the San Joaquin Valley, have been cutting down their nut trees, or not planting other crops leaving their fields fallow. There have been so many books written on that topic that it does not need to be covered here, except to mention, water is a daily concern, especially during the long dry summer months.

Finally, we have the power grid. The state's current goal is of all-renewable power by 2045. Laudable yes, but that may not be realistic. Plus a couple sentences on the dark underside of renewables. Windmills are killing birds, although the numbers are all over the map. From a million to many millions. The arguments and studies range from windmills being the one of the dominant killers, to cats and power line dwarfing what windmills do. Some argue that it is the decimation of raptors where windmills are most damaging. Solar power's mining of rare earths needed to construct solar panels concern many, as the horrible living and working conditions required of the people exploited, in many cases, to exhume the material.

In addition, solar panels have a finite life, and at the end of their life, many early ones are starting to be retired now, and are considered toxic waste, and California does not want them recycled inside their state, and are often shipped to Arizona, and Nevada for disposition. They are hard to disassemble and reclaim any of the reusable materials. The state that is pushing the hardest for their use, wants nothing to do with them when they are done with them!

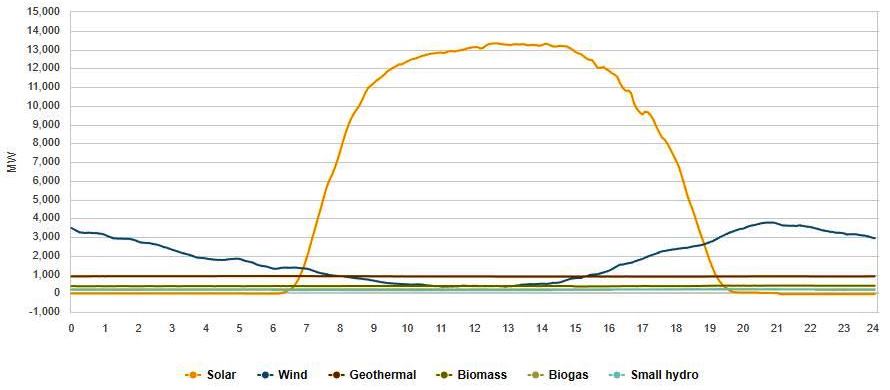

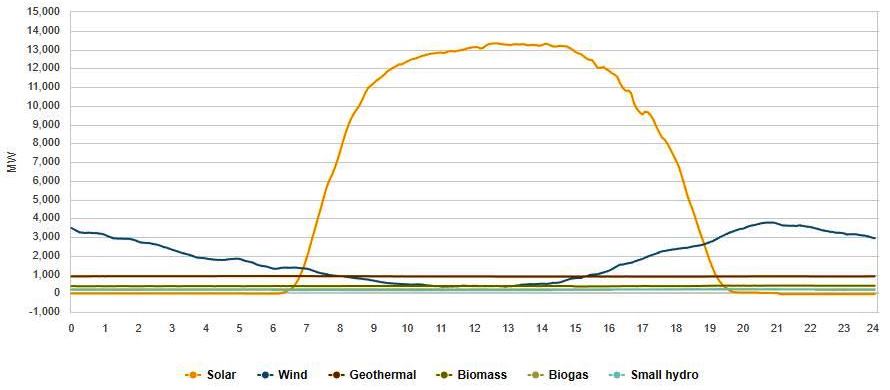

On a typical hot summer day, mid-afternoon, nearly half the available power in California comes from renewables, with solar providing half that. Of the total demand that centers between 30-40,000 MW at its peak during a summer day, wind during mid-day provides between 5 and 7%. While all the state's windmills hypothetically can deliver almost 6000 MW of power, often the total generated at any one time is a fourth that. Evenings and overnights are generally when wind often reaches over one-half of its potential output.

California power situation August 15th, 2022

Notice that renewables are only of significance during daylight hours, and the heavy reliance on Natural Gas overnight

Renewables during many daylight hours means mostly solar. Wind does help some overnight

California power demand and supply snapshot at 7pm on August 16th, 2022

After renewables, natural gas still carries a large percentage of the load, even in the middle of a sunlit day. Often almost 40%. Overnight it and imports from out of state carry the bulk of the load. The states lone surviving nuclear plant holds steady at about 2,250 MW, and hydro generated power, which long term depends on the drought situation, is around 1000 MW. The state also has one remaining, rather small coal plant, on a Indian reservation. It delivers about 8 MW!

On top of that on hot days by late afternoon the need for natural gas sourced power can be higher than renewables. The California Energy Commission has forecast that on peak high demand days the needed power available shortfall due to demand could be 600MW in 2023 and rising to 3300MW by 2025. The largest power utility in the state, PG&E, will also cut power to areas that have a high risk of fire, to prevent its equipment from starting one, which has been the case in a number of catastrophic fires in the last few years.

Other state infrastructure problems loom large. Some 62% of state roads have been rated poor or mediocre. The state is ranked close to the bottom in this metric. K-12 education also rank near the bottom. One-third of Bay Area residents polled were hoping to leave the area soon. Taxes are high, as state sales, income, and gasoline rates among the highest in the U.S.

California has the highest poverty rate in the United States. 1/3 of all American welfare recipients live in the state, and almost a quarter of the state's population lives below or near the poverty line. One in four state residents was not born in the country. Yet the state's gas and electricity prices are among the nation's highest. The state's wealthiest 1 percent, for instance, pay 48 percent of its income tax, and California depends on this tiny elite class, 13% rate being the top paid to the state.

There is an elite class along the Pacific coast that is out-of&45;touch and runs the state. This class has the money to escape the real-life consequences of its own unworkable agendas. Away from the coast, in the central valleys, and in rural and the Sierra foothills, are the people, many who cannot flee to the coast. This class suffers the bulk of the fallout from bloated state regulations, poor schools, and the failure to assimilate recent immigrants from some of the poorest areas in the world. The result some have said is Connecticut and Mississippi combined in one state.

With all of its social programs and their incentive to pull people to the state, it ends up with a state that needs to gleam every tax dollar it can. California has 13.3% tax on capital gains, which inspires plenty of people to leave the state. California's tax collection agency, the Franchise Tax Board (FTB), has gotten much more aggressive in looking for any connection to California. Any can be enough to at least raise tax issues. Not only with residents who move away. FTB makes the line between residents and non-residents a hurdle that only has gotten higher. After a resident leaves the state, the agency is likely to probe how and when they stopped being a resident.

The fair market rent for a two-bedroom apartment is about $1,600. To afford this level of rent and utilities, without paying more than 30 percent of income on housing, a household must earn $64K annually, which equates to a wage of about $31 an hour.

Indeed, the area is a tough place to do business, and employees not in a "professional" class will find their quality of living, outside of the weather and the scenic backdrop, lower than if they were somewhere else.

A Virtual Company

We will conclude this by going back to where we started. By the time you read this the company named after the town might no longer have a physical presence in the area. From the Litton Building to a large, impressive campus out on Bitney Springs Road, to a former mine site in Nevada City, and then back to a site located on top of another mine, The Grass Valley Company is posed to end any residency here. The irony here is that this last site sits atop the mine that was owned by the person who funded the building of a hospital that never became one but was the site of the company's founding.

At one time the Grass Valley Group, as it was originally known, the "Group" for short, had a very large presence in the area. It was the largest employer in the county with over 1100 employees. Whenever the company bonuses were handed out, they were substantial enough to ripple through the entire surrounding communities. The company brought many people up the economic ladder.

Ten years ago the company, while growing in size worldwide, continually shrank here, was down to 400. By the time it moved into the Building on Crown Point it had shrunk to 200. Within the last couple of years it was less than 100. The company is now headquartered in Montreal, Canada.

According to Tim Shoulders, the company's President until November of 2021, the company's hardware manufacturing formerly done in Grass Valley was moved to Montreal over the last decade. As we saw last chapter this was also a reflection of the company's long-term reaction to a decrease in demand for hardware, and toward more software and virtual solutions.

"To keep up, and to keep eyeballs on their own platforms, our customers have to produce a lot more content, and then they have to compete with a lot more people for the rights to that content, and so all of that reduces the amount of revenue they receive for each of the assets they produce," said Shoulders.

"So, they essentially buy less hardware and buy more software, and pay for things as they use it, versus building out humongous infrastructure for their programs," he said.

Undoubtedly the pandemic hastened the move to more employees working remotely in this area. But some employees might be forced to move. He said that some will be relocating to Montreal for proximity to the manufacturing operations, or to cities such as Los Angeles, New York, and Atlanta to work more closely with the company's customers "where the media is happening," said Shoulders.

The company's future is still very much in flux. Besides Shoulders, Marco Lopez, GM of live production, also left the company. Lopez had run Miranda; one of the two companies Belden had forced to merge. Louis Hernandez Jr, who was the CEO of Black Dragon Capital that had bought the combined companies, became what turned out to be its interim CEO and President. In March of 2022 Andrew Cross was named Chief Executive Officer. Cross joined Grass Valley from Vizrt Group, where he was President of Global R&D over all product development across all three brands (Vizrt, NewTek, and NDI). Previously, he was the CEO of NewTek until it was acquired by Vizrt.

What this all means is that, at least for the Grass Valley Company, the bridge from where they were, to where they think they need to be, is still definitely under construction. The hard part? The bridge while being constructed, is still being designed! And finally none of the anchor piers for that bridge will remain in the area.

Interestingly, earlier, Shoulders had said that the company now removed from Grass Valley and residing in Montreal: "We're still carrying the Grass Valley name very proudly."

Or as the French would say: "Vive la vallée herbeuse"

August 2022: Last outpost in the company's namesake!

![]()